Diving deeper into each one:

- Diversification - We spread investments across different asset classes, industries, and regions to reduce risk. This approach ensures that while one investment may perform poorly, others may perform well, balancing the overall portfolio and limiting overall portfolio loss. Think of it as not putting all your eggs in one basket. By diversifying, we aim to protect the portfolio from significant losses and enhance the potential for stable returns.

- Risk protection - Alongside our diversification through multiple managers and investment styles, where it is cost effective to do so we use strategies that tend to provide protection when markets are falling. By incorporating such assets, we aim to cushion the portfolio against market downturns and provide a more stable investment experience.

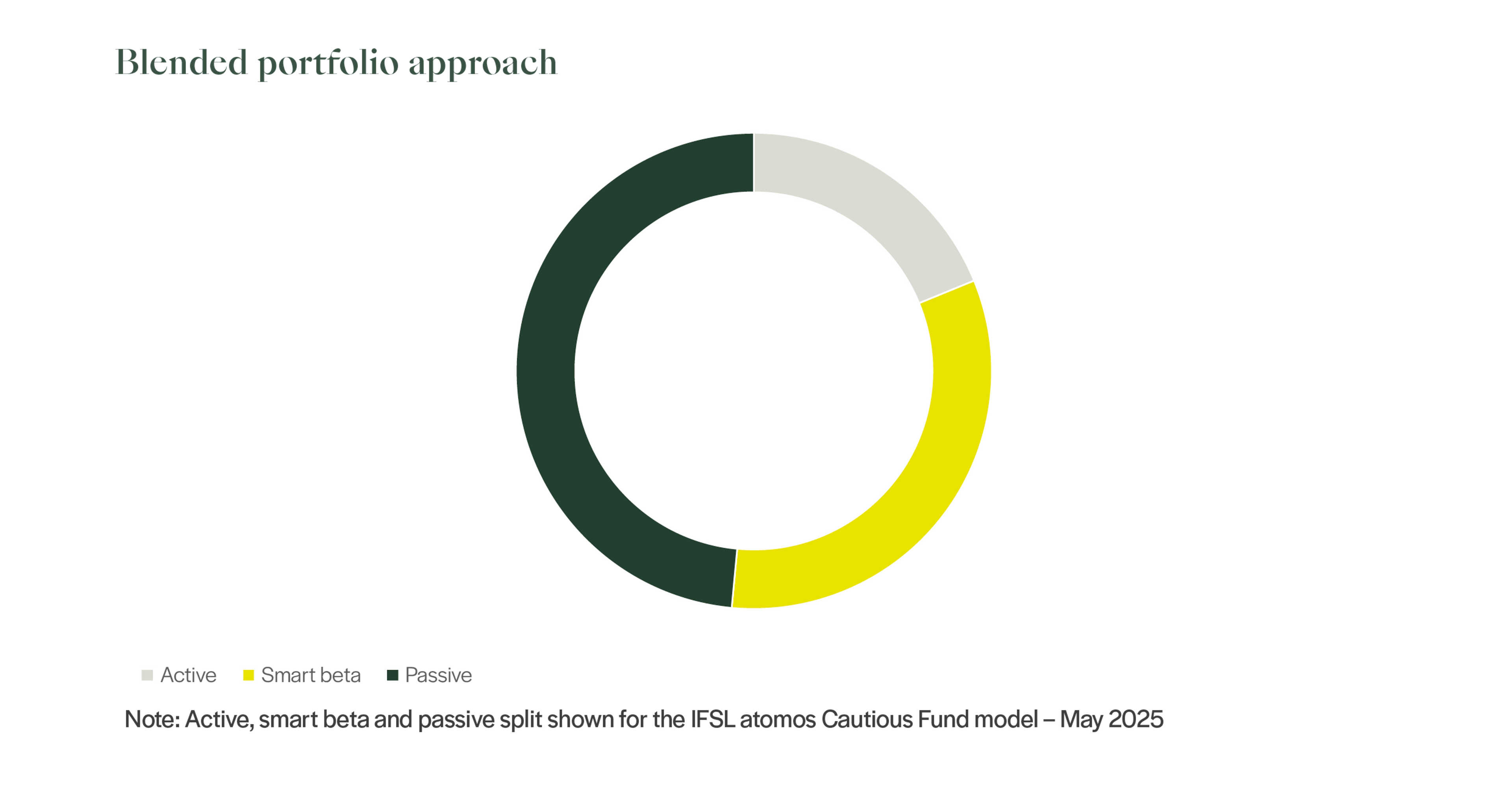

- Active management - Our active managers play a key role in the portfolio by staying closely involved and adjusting investments within their funds as needed. They use detailed research, forward-looking analysis, and professional judgement to identify opportunities in the market. While we don’t often change the managers themselves, we rely on their ability to respond to changing conditions. Their goal is to deliver returns that outperform the broader market, and their ongoing, hands-on approach can offer real value to investors aiming for strong performance.

Monitoring

Once the portfolio has been constructed, we continuously monitor and review our portfolio using various criteria such as risk, return, fees and sustainable investing characteristics (like corporate governance or carbon emissions). This ongoing process ensures that our portfolio remains aligned with our goals and is robust in different economic conditions. Our portfolios are designed to perform well over the entire business cycle – the pattern of growth and decline in an economy over time – which is typically around five years.

We build our portfolios with the expectation that they will meet our defined goals without the need for frequent trading. This approach is important because it helps keep your investments aligned with your long-term goals, even when markets become volatile. By planning for inevitable downturns in advance, we avoid making emotional or reactive decisions—allowing us to stay focused, reduce unnecessary trading costs, and give your portfolio the best chance to grow steadily over time.

Shorter term investment opportunities

While our focus is on long-term investments to drive returns, we also make some calculated short- and medium-term investments to take advantage of expected future growth or attractive current market pricing. By carefully choosing how much money to invest in each idea, we ensure that we don't risk too much money on any single decision. This approach helps us balance potential gains whilst managing risk.Although it depends on the opportunity we’re trying to capture, we would still expect these positions to generate profits over a period of months or even years. Therefore, with our shorter-term investment opportunities we still would not expect frequent trading. Avoiding frequent trading helps reduce costs, keeps the strategy focused, and gives your investments time to grow without being disrupted by short-term market movements.

Our main goal is to build portfolios that can handle uncertain times while staying invested. We aim to avoid making quick, rash decisions and stay strategic. However, we remain watchful and are ready to act if needed. We have employed experienced active managers to look for good opportunities on our behalf at the individual stock level, so while big changes might not be visible, the allocation to stocks and securities within our portfolio is always evolving based on market conditions.

Conclusion

We build client portfolios using the same disciplined and rigorous process used by some of the world’s largest institutional investors—such as pension funds and endowments. We follow a consistent approach of defining investment goals, assessing different risks, and selecting opportunities that align with our clients’ objectives. This institutional approach ensures that your portfolio benefits from the same level of care, insight, and expertise as those managing billions in assets.